Best Sexual Assault Lawyers

Call Us 24 Hours A Day 800-270-8184 or Emergency Cell 818-355-4076

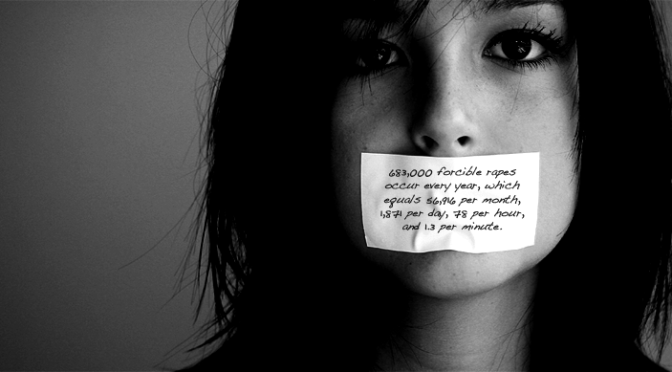

Felony Sexual Assault is a forced sexual intercourse through physical and or psychological intimidation.

There are different types of sexual assault such as date sexual assault, statutory sexual assault, and spousal sexual assault. Date sexual assault is a forced sex act between two people whom know one another during a social engagement such as a date or going to dinner. Even though the two people know one another, if a sex act was coerced, it is considered sexual assault. Statutory sexual assault is a sex act between an adult and a minor under the legal age of 18. Even if the minor consents to the sex act, it is still considered statutory sexual assault, because of the age limit. Spousal sexual assault is a forced sex act between a husband and wife. If a husband or wife does not consent to a sex act, and the sex act is forced, it is considered sexual assault.

Sexual assault Conviction Punishments Sexual assault is a severe sex crime. If a person is convicted of sexual assault, he or she faces a variety of punishments such as:

-

Imprisonment for sexual assault

-

Court ordered rehabilitation for sexual assault

-

Monetary fines for sexual assault

-

Loss of the right to vote for sexual assault

-

Loss of the right to own a deadly weapon if convicted of sexual assault

-

Probation requirements for sexual assault convictions

Punishments can be superior if the offender committed statutory sexual assault, has prior criminal convictions, is on probation, or if there are aggravating circumstances.

People who are convicted of sexual assault must list their name on the Sex Offender Registry. According to Sex Offender Registration Act, sex offenders are categorized by risk of re-offense. The court decides if the convicted offender is (low risk), (moderate risk), or (high risk). The court also categorizes each convicted sex offender as a sexual predator, sexually violent offender, or predicate sex offender. If a persons name is on the Sex Offender Registry, they may have limited employment and housing options, as future landlords and employers look negatively upon sex crime convictions.

Tallahassee Sexual Assault Lawyers – Orlando Sexual Assault Lawyers – Dallas Sexual Assault Lawyers – Fort Worth Sexual Assault Lawyers – Honolulu Sexual Assault Lawyers – Boise Sexual Assault Lawyers – Bismarck Sexual Assault Lawyers – Grafton Sexual Assault Lawyers – Raleigh Sexual Assault Lawyers – Durham Sexual Assault Lawyers – Santa Fe Sexual Assault Lawyers – Albuquerque Sexual Assault Lawyers – Albany Sexual Assault Lawyers – Phoenix Sexual Assault Lawyers – Peoria Sexual Assault Lawyers – Las Vegas Sexual Assault Lawyers – Louisville Sexual Assault Lawyers – Little Rock Sexual Assault Lawyers – Los Angeles Sexual Assault Lawyers – Miami Sexual Assault Lawyers – Des Moines Sexual Assault Lawyers – New Haven Sexual Assault Lawyers – Indianapolis Sexual Assault Lawyers – Detroit Sexual Assault Lawyers – Joplin Sexual Assault Lawyers – Biloxi Sexual Assault Lawyers – Oklahoma City Sexual Assault Lawyers – Portland Sexual Assault Lawyers – Sioux Falls Sexual Assault Lawyers – Nashville Sexual Assault Lawyers – Memphis Sexual Assault Lawyers – Houston Sexual Assault Lawyers – Tacoma Sexual Assault Lawyers – Minneapolis Sexual Assault Lawyers – Provo Sexual Assault Lawyers – Tulsa Sexual Assault Lawyers – Annapolis Sexual Assault Lawyers – Sacramento Sexual Assault Lawyers – Denver Sexual Assault Lawyers – Charlotte Sexual Assault Lawyers –Boston Sexual Assault Lawyers – Olympia Sexual Assault Lawyers – Atlanta Sexual Assault Lawyers – Santa Monica Sexual Assault Lawyers – Malibu Sexual Assault Lawyers – Tucson Sexual Assault Lawyers– Scottsdale Sexual Assault Lawyers – Beverly Hills Sexual Assault Lawyers – Boca Raton Sexual Assault Lawyers

Wise Laws affiliated sexual assault lawyers understand that if you have been charged with sexual assault, it is important that you seek the representation of a professional sex crimes attorney. An experienced sexual assault lawyer can investigate your case, interview key witnesses, challenge evidence presented against you, and defend your legal rights.

Wise Laws lawyers have represented various clients throughout during their sexual assault cases. Our attorneys know that early preparation and investigation can help identify the facts surrounding your case. With our expert legal knowledge, we can notify you of your options, negotiate charges with prosecutors, develop appropriate motions to suppress evidence, and build a strong defense on your behalf. At the offices of Wise Laws, we know how sensitive sexual assault charges can be for our clients and their families.

If you have been charged with sexual assault, contact Wise Laws immediately