November’s law legalizing recreational weed has added a new set of challenges for regulation

Marijuana for medical use has been legal in California since 1996, but efforts to regulate it like a normal product have been elusive.

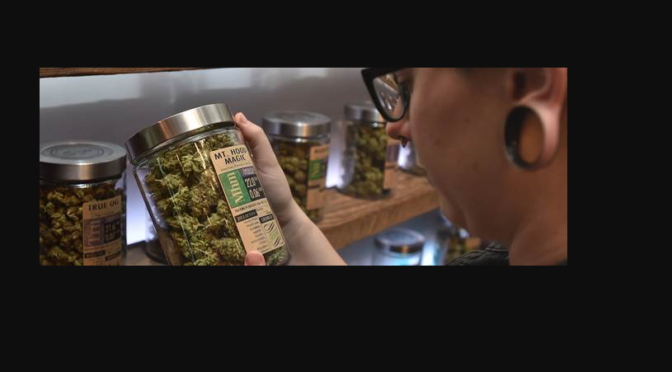

For nearly two decades the production, distribution, sale and taxation of cannabis has operated through a patchwork of local rules that can differ from one city or county to the next. What one grower or pot dispensary does in one part of the state could be illegal in another, from the number of plants producers can grow to whether or not cannabis-based edibles require warning labels.

Now that voters have approved the sale of marijuana for recreational use through November’s Proposition 64 referendum, officials involved with working out regulations are scrambling. They must establish statewide rules before the start of next year, when licenses are supposed to become available for the sale of recreational-use marijuana.

Some are doubtful that state policymakers will have everything in order by then.

“They can’t get it together about what they want the laws to be,” Alicia Darrow, chief operations manager of Blum Oakland, a 13-year-old Bay Area medical marijuana dispensary, told Salon. “I’ll be shocked if it goes live in 2018.”

The problem, she said, is that Prop. 64 threw a wrench into regulators’ efforts that began in October 2015 after the passage of Assembly Bill 266, the state’s first successful attempt to pass a law regulating medical marijuana.

Prop. 64 and AB 266 have considerable differences in the way marijuana is regulated that must be worked out. For example, AB 266 requires a small number of third-party companies to control distribution and oversee testing for pesticide contamination, something dispensaries argue is unnecessary and would increase costs. Another unanswered question pertains to how dispensaries that sell medical-use marijuana and the more heavily taxed recreational-use weed will be required to track and manage their inventories and sales. Under Prop. 64, dispensaries must have two separate inventories and tracking systems.

“It’s a big job, but we’re working hard and have every intention of meeting our goals,” Alex Traverso, a spokesman for the state’s Bureau of Medical Cannabis Regulation, said in an email to Salon. “The work we’ve done on regulations for medical cannabis have given us a great start.”

Meanwhile established growers, many of them mom-and-pop operations, are worried about being muscled out by bigger, well-financed ventures backed by deep-pocketed investment groups that are chasing the potential for big gains in the years to come. California’s medical marijuana business generated nearly $2.7 billion in sales in 2015 and that’s expected to balloon to $6.45 billion annually by 2020, including sales from recreational-use marijuana, according to cannabis industry investment network Arcview.