MARCH 31, 2016 6:56pm PT by Ashley Cullins

The deadmodz vape brand is confusing deadmau5 fans who think the electronic music star is behind the electronic cigarette line, according to the lawsuit.

Electronic dance music master Joel Zimmerman says West Coast Vape Supply is intentionally infringing on his deadmau5 trademark, according to a federal lawsuit filed on Thursday in California.The deadmodz electronic cigarette line is trying to capitalize on Zimmerman’s fame, and according to the lawsuit the products “overlap with, are closely related to deadmau5’s goods and services and/or represent a natural zone of expansion for deadmau5, and such goods are or would be marketed and sold to the same types of consumers through the same channels of trade.”

Zimmerman is suing for trademark infringement and false association, and is seeking statutory and punitive damages and a permanent injunction to ban West Coast Vape from using deadmodz.

His attorney Irene Lee sent a statement to The Hollywood Reporter saying they’re suing to protect the artist’s trademark and his fans.

“Our client faces unscrupulous people trying to take advantage goodwill associated with his intellectual property and his fame,” Lee writes. “We are grateful for our fans and believe it’s our obligation to make sure our fans are not duped into buying things that deadmau5 did not authorize.”

The lawsuit claims deadmau5 is not only a trademark, but a brand Zimmerman has been building for more than a decade. It also explains the origins of his onstage persona.

In 2002 Zimmerman took his computer apart and found a dead mouse inside. When he posted the story online, people started referring to him as “dead mouse guy.” He embraced the new nickname and tried to change is screen name to “deadmouse” but found the Internet Relay Chat channel he was using limited usernames to eight characters. Using leet spelling, he became deadmau5.

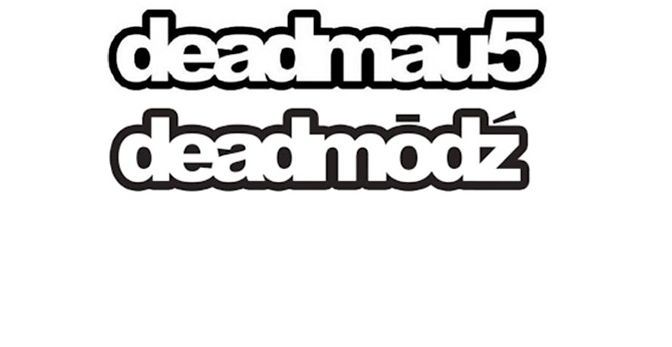

Not only is the name “deadmodz” similar to “deadmau5,” Lee argues, but also the vape company copied the bubble font Zimmerman uses in his logo.

Lee shared this photo, which is an exhibit to the suit:

In an effort to avoid the litigation, Zimmerman’s transactional attorney Dina LaPolt sent several letters to Alham Benyameen, the principal of West Coast Vape.

After an initial cease and desist letter, sent on Feb. 5, Benyameen substantially changed his website and logo design.

In response LaPolt made it clear that wasn’t good enough and tried again to settle out of court in a Feb. 19 letter.

“Please understand that your attempted changes do not negate that fact that you have violated and continue to violate our client’s rights, and thus are liable for, among other things, trademark and copyright infringement and attendant damages,” LaPolt writes. “In fact, your changes only highlight your acknowledgement and concession of wrongdoing, which admittedly is willful, knowing and intentional.”

When they didn’t respond, Lee prepared the suit.

“Instead of conceding their wrongdoing and agreeing to comply with our requests, they refused to acknowledge deadmau5’s intellectual property rights and their wrongdoing, necessitating this legal action,” she writes in her statement to THR. “We intend to vigorously protect deadmau5’s rights.”

West Coast Vape did not immediately respond to a request for comment.

Sourced From – http://www.hollywoodreporter.com/thr-esq/deadmau5-sues-vape-company-trademark-879815